One is making a note in your cash book (faster to do, but less detailed), and the other is to prepare a bank reconciliation statement (takes longer, but more detailed). Once you’ve figured out the reasons why your bank statement and your accounting records don’t match up, you need to record them. The balance recorded in your books (again, the cash account) and the balance in your bank account will rarely ever be exactly the same, even if you keep meticulous books. Hopefully you never lose any sleep worrying about fraud—but reconciling bank statements is one way you can make sure it isn’t happening. When they draw money from your account to pay for a business expense, they could take more than they record on the books. Adjust the cash balances in the business account by adding interest or deducting monthly charges and overdraft fees.

Identify errors with check deposits

If not, you’re most likely looking at an error in your books (or a bank error, which is less likely but possible). If you suspect an error in your books, see some common bank reconciliation errors below. In other words, the adjusted balance as per the bank must match with the adjusted balance as per the cash book. In such a case, you simply need to mention a note indicating the reasons for the discrepancy between your bank statement and cash book.

Errors Made by Your Business or your Bank

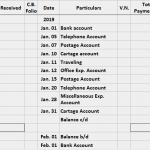

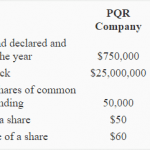

To do this, businesses need to take into account the bank charges, NSF checks and errors in accounting. (c) A deposit of $5,000 received by the bank (and entered in the bank statement) on 28 May does not appear in the cash book. Hence, at the end of each month, the first thing to do is to consult the bank reconciliation statement prepared at the end of the previous month. One of the procedures for establishing the correct cash balance (and for controlling cash) is the reconciliation of the bank and book cash balances. Search the bank statement for any interest your account earned during the month, then add it to your reconciliation statement.

How often should you reconcile your bank account?

The reconciliation statement allows the accountant to catch these errors each month. The company can now take steps to rectify the mistakes and balance its statements. Auto-reconciling transactions reduces human errors, such as keying inaccuracies and adds security to the reconciliation process.

Step 5: Create journal entries

If the mistake is on the bank’s end, contact the bank and inform them. Bank reconciliation done through accounting software is easier and error-free. The bank transactions are imported automatically allowing you to match and categorize a large number of transactions at the click of a button.

- However, in practice there exist differences between the two balances and we need to identify the underlying reasons for such differences.

- Note that this process is exclusively for reconciliations performed by hand.

- Businesses that use online banking service can download the bank statements for the regular reconciliation process rather than having to manually enter the information.

- As with deposits, take time to compare your personal records to the bank statement to ensure that every withdrawal, big or small, is accounted for on both records.

- Incorrectly recording transactions in the accounting system can result in errors in the balance sheet and bank statement, making it challenging to reconcile.

- After adjustments are made, the book balance should equal the ending balance of the bank account.

Time-saving

It shows what transactions have cleared on your statement with the corresponding transaction listed in your journal. To reconcile means to “make one view or belief compatible with another.” In accounting, that means making your account balances equal to one another. More specifically, a bank reconciliation means balancing your bank statements with your bookkeeping. Sometimes your current bank account balance is not a true representation of cash available to you, especially if you have transactions that have not settled yet. If you’re not careful, your business checking account could be subject to overdraft fees.

You first need to determine the underlying reasons responsible for the mismatch between balance as per cash book and passbook. Once you have determined the reasons, you need to record such changes in your books of accounts. Typically, the difference between the cash book and passbook balance arises due to the items that appear only in the passbook. Therefore, it makes sense to first record these items in the cash book to determine the adjusted balance of the cash book. As mentioned above, debit balance as per the cash book refers to the deposits held in the bank. This balance exists when the deposits made by your business at your bank are more than the withdrawals.

For example, a restaurant or a busy retail store both process a lot of transactions and take in a lot of cash. They might reconcile on a daily basis to make sure everything matches and all cash receipts hit the bank account. On the other hand, a small online store—one that has days when there are no new transactions cost of goods sold definition formula and more at all—could reconcile on a weekly or monthly basis. For the most part, how often you reconcile bank statements will depend on your volume of transactions. If you do your bookkeeping yourself, you should be prepared to reconcile your bank statements at regular intervals (more on that below).

With the true cash balance reported in the Cash account, the company could prevent overdrawing its checking account or reporting the incorrect amount of cash on its balance sheet. The bank reconciliation also provides a way to detect potential errors in the bank’s records. The information on your bank statement is the bank’s record of all transactions impacting the company’s bank account during the past month. Compare the ending balance of your accounting records to your bank statement to see if both cash balances match. We strongly recommend performing a bank reconciliation at least on a monthly basis to ensure the accuracy of your company’s cash records.

The cash column in the cash book shows the available cash while the bank column shows the cash at the bank. Deposits in transit are amounts that are received and recorded by the business but are not yet recorded by the bank. Do you want to test your knowledge about https://www.business-accounting.net/is-accounts-payable-an-expense/? While this will cause a discrepancy in balances at the end of the month, the difference will automatically correct itself once the bank collects the checks. In the case of items in transit, these arise from several circumstances. The firm’s account may contain a debit entry for a deposit that was not received by the bank prior to the statement date.

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. This transaction results in the bank’s assets decreasing by $1,000 and its liabilities decreasing by $1,000. When you join PRO Plus, you will receive lifetime access to all of our premium materials, as well as 10 different Certificates https://www.adprun.net/ of Achievement. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Since the notification had not been received, it was necessary to put this item on the reconciliation. The usual procedure calls for the bank to send the depositor not only the notification but also the check itself.

Also, deduct any penalties or fees the bank assessed that your ledger doesn’t list. The reconciliation process allows a business to understand its cash flow and manage its accounts payable and receivable. Therefore, when your balance as per the cash book does not match with your balance as per the passbook, there are certain adjustments that you have to make in order to balance the two accounts. When you prepare the bank reconciliation statement for the month of November as on November 30, 2019, the cheque issued on November 30 is unlikely to be cashed by the bank.