If you’re finding withdrawals that aren’t listed on the bank statement, do some investigation. If it’s a missing check withdrawal, it’s possible that it hasn’t been cashed yet or wasn’t cashed by the statement deadline. Consider performing this monthly task shortly after your bank statement arrives so you can manage any errors or improper transactions as quickly as possible. Keeping accurate records of your bank transactions can help you determine your financial health and avoid costly fees. Using this simple process each month will help you uncover any differences between your records and what shows up on your bank statement.

Common errors and how to avoid them

The above case presents preparing a bank reconciliation statement starting with positive bank balances. Bank reconciliation helps to identify errors that can affect estimated tax payments and financial reporting. The reconciliation statement allows the accountant to catch these errors each month. The company can now take steps to rectify the mistakes and balance its statements. If an error is identified during the reconciliation process, it’s not always at the company’s end. Banks can also make errors, and if the mistake can’t be identified, contact the bank.

Document the process

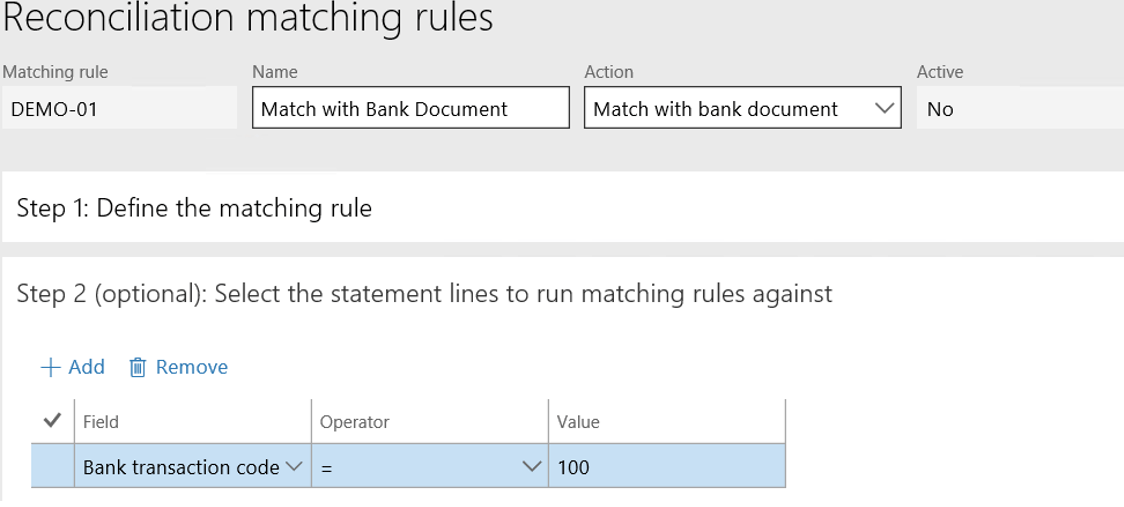

Bank reconciliation is the process of comparing accounting records to a bank statement to identify differences and make adjustments or corrections. In the case of personal bank accounts, like checking accounts, this is the process of comparing your monthly bank statement against your personal records to make sure they match. Many banks allow you to opt for fee-free electronic bank statements delivered to your email, but your bank may mail paper bank statements for a fee. https://www.intuit-payroll.org/ The reconciliation of bank statements is a critical step in maintaining accurate financial records for any business, ensuring that the company’s accounting records are up-to-date and accurate. By reconciling bank statements regularly, business owners can identify any missing or duplicate transactions, bank errors, or fraudulent activity early on, before they pose significant challenges. This process ensures accurate tracking of financial transactions and balances.

Bank statement shows something that’s not in your business books?

- As with deposits, take time to compare your personal records to the bank statement to ensure that every withdrawal, big or small, is accounted for on both records.

- Errors can occur in both the recordkeeping systems of both the bank and the depositor.

- He is the founder of the award-winning blog, Family Money Adventure, and host of the Family Money Adventure Show podcast.

- This is useful for comparing the totals in your books to the totals on your bank statement.

- Let’s say you check your records at the end of a certain period, and while calculating your total figures and cross-checking them with your bank statement, something doesn’t add up.

This balance exists when the deposits made by your business at your bank are more than the withdrawals. If you want to prepare a bank reconciliation statement using either of these approaches, you can take balance as per the cash book or balance as per the passbook as your starting point. NSF cheques are an item to be reconciled while preparing the bank reconciliation statement. This is because when you deposit a cheque in your bank account, you consider that the cheque has been cleared by the bank. It is important to note that such charges are not recorded by you as a business till the time your bank provides you with the bank statement at the end of every month.

Bank Reconciliation Statement

The banks at issue are small, removing them from direct oversight of the Consumer Financial Protection Bureau. An agency report detailed how fintech ‘neobanks’ could fall into the regulatory cracks. what are provisions in accounting Nobody managed to patch them up, and now depositors can’t retrieve their own money. Accounts Payable teams must adhere to the important features of accurate, regular vendor reconciliation.

To help you master this topic and earn your certificate, you will also receive lifetime access to our premium bank reconciliation materials. These include our visual tutorial, flashcards, cheat sheet, quick tests, quick test with coaching, and more. For example, the payees may be contacted to determine if the checks have been misplaced.

Reconciling is the process of comparing the cash activity in your accounting records to the transactions in your bank statement. This process helps you monitor all of the cash inflows and outflows in your bank account. The reconciliation process also helps you identify fraud and other unauthorized cash transactions. As a result, it is critical for you to reconcile your bank account within a few days of receiving your bank statement. To reconcile bank accounts, compare your bank statement to your records, noting any discrepancies. Adjust your records to match the bank statement, considering deposits, withdrawals, fees, and errors.

For some reason, Sample Company was not notified about the NSF check. If the deposit was made toward the end of the month, there would be no need to notify the bank. You can safely exit the reconciliation screen without losing your progress by clicking the Save for later button at the top. After recording the $700 payment from Kristen, you can go back to the reconciliation screen and tick the payment. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided. And set up a system that makes it quick and easy to grab the records you need.

Whether this is a smart decision depends on the volume of transactions and your level of patience. Reconciling your bank statements lets you see the relationship between when money enters your business https://www.personal-accounting.org/commitment-amount/ and when it enters your bank account, and plan how you collect and spend money accordingly. The goal of bank account reconciliation is to ensure your records align with the bank’s records.

Follow the process we’ve laid down step-by step, and soon you’ll be prepped for bank reconciliations! With accounting software like Zoho Books, doing a bank reconciliation is even easier with quick and direct access to your bank statement and records, along with an easy reviewing and matching process. The bank may have charged you for something that isn’t recorded in your ledger.

A bank reconciliation is when you compare your cash inflow and outflow (your cash balance in your ledger) with your bank records for a certain period, and make adjustments to match them. The discrepancies between the two could be due to many reasons, including errors you’ve made while entering an amount, duplicate entries, a payment that’s yet to clear, or even bank interests and fees. When you check these and reconcile them, you can verify your transactions for that period and ensure that your records are accurate, with everything accounted for. A bank reconciliation statement is a document that compares the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Reconciling the two accounts helps identify whether accounting changes are needed. Bank reconciliations are completed at regular intervals to ensure that the company’s cash records are correct.

Common errors include entering an incorrect amount or omitting an amount from the bank statement. Compare the cash account’s general ledger to the bank statement to spot the errors. There are times when the bank may charge a fee for maintaining your account. Therefore, while preparing a bank reconciliation statement you must account for any fees deducted by the bank from your account. This is done by taking into account all the transactions that have occurred until the date preceding the day on which the bank reconciliation statement is prepared. When your business receives cheques from its customers, such amounts are recorded immediately on the debit side of the cash book.