Customers can pay instantly by credit card or Apple Pay when they view the invoice online. Simply email your customers an invoice and they can use the secure “Pay Now” button to send over your payment. I look at the dashboard and know how many invoices are on the way, when they should be paid, and the average time it takes someone to pay. It keeps me on track and takes a lot out of my hands. Import, merge, and categorize your bank transactions.

Speed up cash flow with online payments.

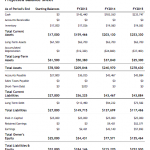

Our robust small business accounting reports are easy to use and show month-to-month or year-to-year comparisons so you can easily identify cash flow trends. To upgrade to the Pro Plan, sign into Wave. Visit your dashboard or use your invoicing or accounting features, and click the peach “Upgrade now” button. Learn more about changing subscription periods and plan types, and how to cancel your Pro subscription in our Help Centre. 2 Rates are 1% for bank payments (minimum fee of $1). For information on credit card rates, visit Pricing for details.

Recurring billing for repeat customers

Wave’s accounting software is built for small business owners. Be your own accountant, thanks to Wave’s automated features, low cost, and simple interface. Have an eye on the big picture so you can make better decisions. Our accounting reports are easy to use and show monthly or yearly comparisons, so you can easily identify cash flow trends.

Keep track of your business health

Online payments allows you to get paid quickly by bank deposit, credit card, and Apple Pay. With a Wave Pro subscription, you’ll have recurring billing and other automation features. Schedule everything, from invoice creation and invoice sending, to payment collection and overdue payment reminders. Sign up for Wave and send your first invoice right away—it only takes a few minutes! With the Pro Plan you can also set up recurring payments, auto-reminders, and deposit requests to make sure you always get paid on time. Know when an invoice is viewed, becomes due, or gets paid, so you can take the right actions to manage your cash flow.

“Wave invoicing makes your life a whole lot easier and takes that worry off you. I’ve tried Quickbooks—it’s a bit more complicated and technical, and takes more time to set up.” Monitor your cash flow, stay organized, and stop sweating tax season. Say #sorrynotsorry to your spreadsheets https://www.business-accounting.net/ and shoeboxes. Between the app and the payment process—I can’t tell you the hours it’s saved, and even the headaches that have gone away because of it. Know when an invoice is viewed, becomes due, or gets paid, so you can stay on top of your cash flow better than ever.

When I signed up with Wave it was a no brainer. It’s been one of the best decisions I’ve made when it comes to making sure my accounting is https://www.personal-accounting.org/bookstime-accounting/ on point. Our (non-judgmental) team of bookkeeping, accounting, and payroll experts is standing by to coach you—or do the work for you.

- Wave is a PCI-DSS Level 1 Service Provider.

- Wave’s smart dashboard organizes your income, expenses, payments, and invoices.

- Electronic invoices are created with online invoicing software or other cloud-based services, which makes it easy to automate the invoicing process.

- Payments are a pay-per-use feature; no monthly fees here!

- Manually creating invoices in Microsoft Word or Excel can be time-consuming and difficult to manage.

- When I signed up with Wave it was a no brainer.

Want to look more polished, save more time, and conquer cash flow? The developer, Wave Financial Inc, indicated that the app’s privacy practices may include handling of data as described below. Easily monitor and keep track of what’s going on in your business with the intuitive dashboard.

Any connections between you, your bank accounts, and Wave are protected by 256-bit SSL encryption. Wave is a PCI-DSS Level 1 Service Provider. Allow your customers to pay your invoices immediately via credit card, secure bank payment (ACH/EFT), or Apple Pay. You’ll both appreciate the speed and convenience. This app is super helpful, the main issue I have while using it is the lag. When inputting information the character count for it is super slow/delayed to where it forces me to stay on a certain page until it registers that information has been inputted.

All your invoicing and payment information automatically syncs with Wave’s accounting feature. Yes, switching from other accounting income tax expense apps or products to Wave is easy! See our step-by-step guide on how to import bookkeeping data into Wave here.

Approval to use online payments is subject to eligibility criteria, including identity verification and credit review. You’ll need to answer a few questions about your business and provide us with a little more information about yourself in order to get approved to accept online payments. With Wave, your invoices and payments automatically flow into your accounting records. You’ll never lose track of payments again, and you’ll be all set at tax time.